This section describes the specifics of accessing and interpreting the Operating Profit Estimates (Profit & Loss) report.

The operating profit is the profit earned from the company normal core business operations. This value does not include any profit earned from the company investments, such as earnings from companies in which the company has partial interest, and before the deductions of applicable interest and taxes owed.

The operating profit is calculated using the following formula:

Operating Profit = Operating Revenue - COGS - Operating Expenses - Depreciation and Amortization

If the numbers seem out of normal, it is a direct reflection on what was entered into the system, since this data is pulled from the data entry module in CStoreOffice®.

Opening the Report

You can find the report at Reports > Accounting > Operating Profit Estimates (Profit & Loss).

The Operating Profit Estimates (Profit & Loss) report can be opened at all levels:

- Account

- Company

- Division

- Location (Station)

For more information, see Viewing Reports.

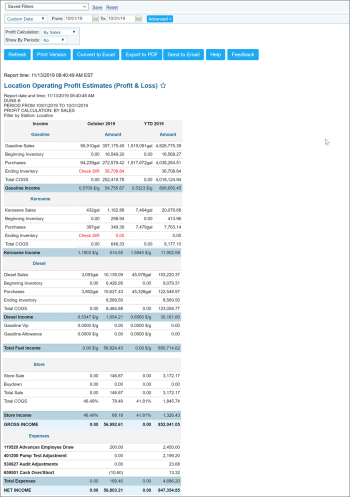

Viewing the Report

The report contains the following sections:

- Gasoline: Information about the operating profit on gasoline. To drill down into the profit details, click a corresponding line in this section. For example, to open the Fuel Sales Detailed report, click the Gasoline Sales line.

- Kerosene: Information about the operating profit on kerasene. To drill down into the profit details, click a corresponding line in this section. For example, to open the Kerosene / Diesel Sales report, click the Kerosene Sales line.

- Diesel: Information about the operating profit on diesel. To drill down into the profit details, click a corresponding line in this section. For example, to open the Kerosene / Diesel Sales report, click the Diesel Sales line.

- Store: Information on the merchandise operating profit. To drill down into the profit details, click a corresponding line in this section. For example, to open the Store Sales Detailed report, click the Store Sales line.

The GPM value in the Store Income row in this section is calculated by the following formula: GPM = (Total Sale - Total COGS)/Total Sale. - Expenses: The store expenses.

Filtering the Report Data

To get the exact information you need, you can apply filters to the report. To set up a filter, select one or more filtering options. Once the filter is set up, at the bottom of the filter section, click the Refresh button to display the report data by the filter criteria.

The report provides the following filtering options:

- Date: Select the corresponding filtering option from the list or specify the period in which you are interested.

- Stations Included: Select the locations for which you want to view the report.

- Profit Calculation: Select profit calculation method — by sales or by purchases.

- Show By Periods: Select the period by which you want the report data displayed — by week, by month, by quarter or by year.

For more information on additional report features, see Reports.